Report Store Details

- Home

- Report Store Details

Philippines Used Car Market Analysis and Forecast (2019-2030) - by Brand, Car Type, Body Type, Fuel Type, Cities and Age Group

- 15 Apr 2024

- Report Code: MK20611

- No of Pages: 103

Price From: $1700

- Description

- Table Of Content

- Request Free Sample

Philippines Used Car Market Size

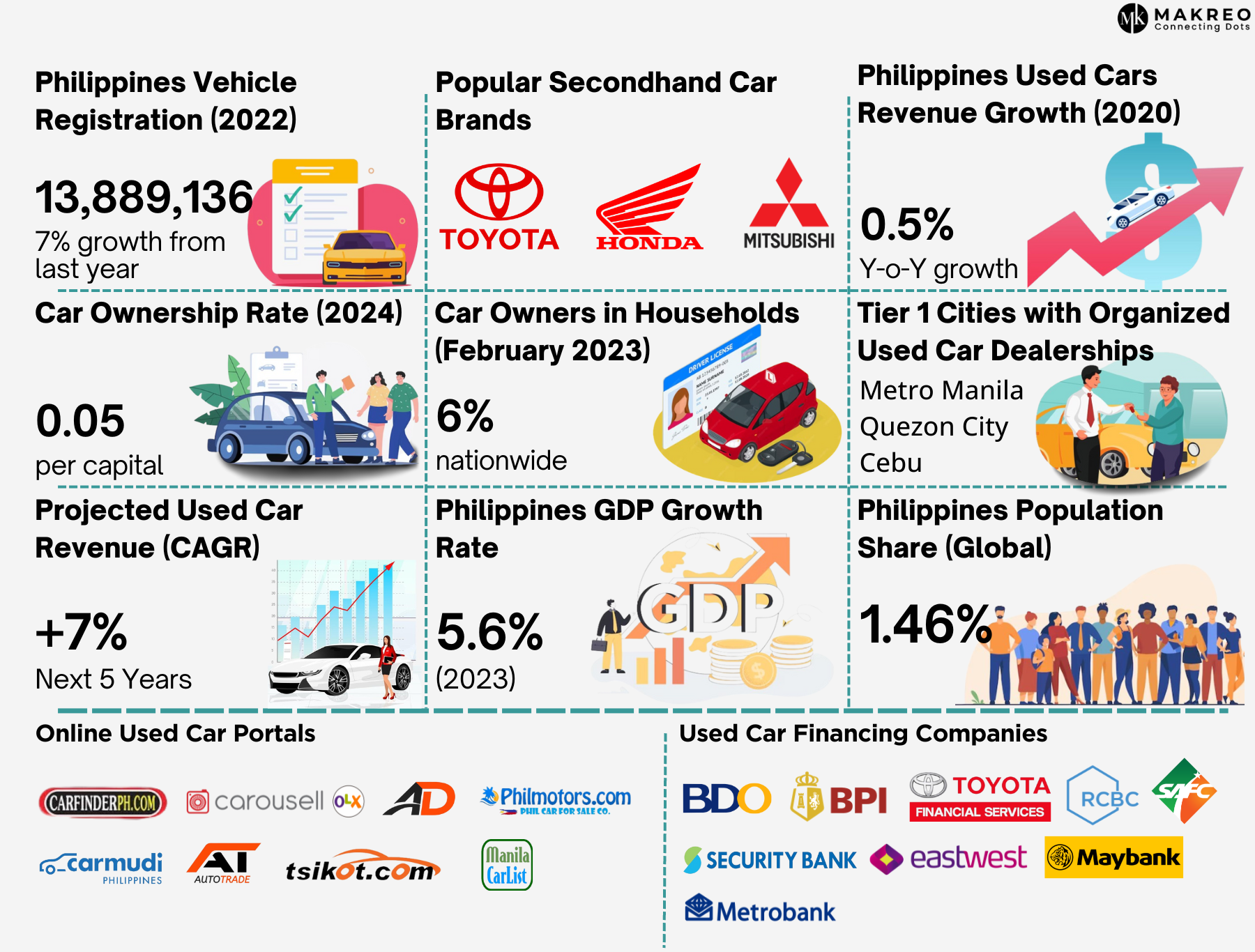

The Philippines used car market has experienced remarkable growth, showcasing a robust Compound Annual Growth Rate (CAGR) exceeding 12% from 2019 to 2023. During this period, used car sales skyrocketed, surpassing a staggering 1.2 million units, with a rapid growth rate in sales volume of over 7%. This surge in demand is particularly notable in tier 2 cities, which have emerged as the primary consumers of the Philippines used car market. However, tier 1 cities such as Metro Manila, Quezon City, and Cebu City continue to exhibit significant interest in the used car segment. This trend underscores the evolving dynamics and increasing prominence of the used car industry across the Philippines.

The Philippines' used car industry is currently witnessing fierce competition among key players, all trying to secure a larger share in this rapidly evolving sector. Leading companies such as Automart.PH, Carmudi Philippines, Zigwheels Philippines, Toyota Motor Philippines Corporation (T sure), and AutoDeal.com.ph are leading this competition by implementing innovative strategies and expanding their footprint to meet the escalating demand for high-quality pre-owned vehicles. As the market experiences significant growth, online platforms gain traction, with companies striving for market dominance and seeking to differentiate themselves through superior service quality, competitive pricing, and technological advancements.

Moreover, the Philippines used car industry is witnessing a rise in mergers, acquisitions, and strategic investments among major players, offering growth opportunities for foreign players amid the existence of a large number of unorganized players. These alliances aim to capitalize on each other's strengths, broaden market capabilities, and offer comprehensive end-to-end solutions to consumers. With customers increasingly demanding faster delivery and real-time tracking, used car service providers are under pressure to provide more flexible and consumer-centric solutions. Companies capable of adapting to these evolving demands stand to gain a competitive advantage in the Philippines used car market.

Philippines Used Car Market Revenue, 2019-2023

Growing Popularity of Organized Market Structure in the Philippines Used Car Market

In the Philippines, the used car market is experiencing remarkable growth, with sales facilitated by organized players gaining significant traction. This trend reflects the increasing demand for certified pre-owned vehicles among consumers, who are drawn to the enhanced services and value offered by these established entities. The certification process, a hallmark of these organized players, ensures that vehicles meet stringent quality standards, mitigating the risks associated with purchasing used cars. This assurance is particularly appealing in a market where concerns about vehicle reliability are prevalent. Moreover, the presence of organized players has led to greater market transparency and fair pricing practices, further fueling their popularity among buyers in the Philippines' used car industry. As a result, the landscape of the Philippine's used car market is evolving, driven by the commitment of these major players to provide reliable, quality vehicles to discerning customers.

Countries With Lowest Car Ownership Rates, 2024

Philippines Used Car Market Developments

-

The Philippines used car market has undergone a significant digital transformation, revolutionizing operations and creating a more efficient and trustworthy marketplace. This shift aligns with the broader trend of leveraging technology to overcome traditional industry challenges and enhance the consumer experience. Despite these advancements, car ownership remains relatively low, with only 6% of households nationwide owning a vehicle as of February 2023, presenting substantial growth opportunities for the market.

-

One notable trend is the concentration of organized used car dealerships in key urban centers like Metro Manila, Quezon City, and Cebu. These cities host over 50% of all outlets in Tier 1 cities, underscoring their importance in the Philippines' used car landscape.

-

Japanese and South Korean automotive brands currently hold a dominant position in the market, with Chinese brands emerging as noteworthy contenders in recent years. Models like the Toyota Vios, Honda City, and Mitsubishi Mirage are particularly esteemed for their reliability, fuel efficiency, and robust resale value and are thus well appreciated in the Philippines used car market.

-

The Philippines has emerged as one of Southeast Asia's premier destinations for used car transactions, driven by a young and rapidly growing population's demand for affordable transportation options. As economic opportunities expand and disposable incomes rise, more Filipinos can afford vehicles, further boosting the demand for pre-owned cars.

Competition in the Philippines Used Car Industry

The report provides a comprehensive analysis of the Philippines used car market, encompassing a variety of companies operating within the industry. Well-known names such as Automart.PH, Carmudi Philippines, Zigwheels Philippines, Toyota Motor Philippines Corporation (T sure), and AutoDeal.com.ph are featured prominently. Additionally, it includes several online platforms such as Carmudi Philippines, Autodeal, Tsikot, Philmotors, Philkotse, Car Finder Philippines, Motoring and Tech, ManilaCarList, CarsInPhilippines, OLX Philippines, and Auto Trade, catering to different aspects of the market. Furthermore, the financial sector is also covered, incorporating major players such as South Asialink Finance Corp, Security Bank, EastWest Bank, Toyota Financial Services Philippines Corporation (TFSPH), Maybank, RCBC, Metrobank, BPI, and BDO Unibank. These companies represent diverse segments of the industry, ranging from online platforms like Autodeal Philippines and Carmudi to established dealerships like Toyota Motor Philippines Corporation. Their inclusion in the report offers a comprehensive overview of the industry's key players and their influence on the market. The report sheds light on the growth, volume, and size of the Philippine's used car market, as well as the competitive landscape and overall industry dynamics.

Top Offline Used Car Brand Revenue (PHP 183,800 Million)

Top Online Used Car Brand Revenue (PHP 111.5 Million)

Future Growth Outlook of Philippines Used Car Market

Philippines' low car ownership rates, developing infrastructure, and the growth of the organized market is expected to contribute to the promising outlook for the used car industry. With relatively low car ownership rates, a significant pool of potential customers may turn to the used car market for affordable transportation options. Moreover, the ongoing development of infrastructure, such as roads and highways, facilitates easier access to various regions, potentially increasing demand for used cars across the country.

The expansion of organized players in the market enhances consumer trust and confidence by offering reliable services, certified vehicles, and transparent transactions. With an anticipated increase in the population, alongside rising disposable incomes and a growing working woman population, it is expected that used car revenue will reach significant heights by 2028 with a growth rate of 8.10%. The purpose of this analysis is to provide stakeholders with valuable insights into the potential opportunities and challenges present in the market.

Philippines Used Car Market Revenue Forecast, 2024-2028

Scope of Philippines Used Car Market

The research report titled “Philippines Used Car Market Analysis and Forecast (2019-2028) - by Brand, Car Type, Body Type, Fuel Type, Cities and Age Group" by Makreo Research aims to offer a comprehensive analysis of the performance and future growth potential of the Philippines used car market. It intends to assess the market's historical performance and current status, while also identifying key drivers that will impact its future growth trajectory. The report provides detailed insights into various market aspects, including car types, fuel types, car brands, different cities, channel types, and dealer types.

Overall, the research report seeks to provide stakeholders with a thorough analysis of the Philippines used car market, helping them understand its current state, future growth prospects, and potential investment and strategic decision-making opportunities.

2018–2023: Past and Present Scenario

2023 : Base Year

2024–2028: Future Outlook of the Market

-

Organized

-

Unorganized

-

Online

-

Offline

-

Toyota

-

Daihatsu

-

Honda

-

Toyota Avanza

-

Daihatsu Sigra

-

Mitsubishi Xpander

-

Honda Mobilio

-

Sedan

-

SUV

-

Hatchbacks

-

MPV

-

Commercial

-

LCGC

-

Petrol

-

Diesel

-

Hybrid

-

EV

-

Manila

-

Sumatra

-

Surabaya

-

Medan

-

Automart.PH

-

Carmudi Philippines

-

Zigwheels Philippines

-

Toyota Motor Philippines Corporation (T sure)

-

AutoDeal.com.ph

-

Carmudi Philippines

-

Autodeal

-

Tsikot

-

Philmotors

-

Philkotse

-

Car Finder Philippines

-

Motoring and Tech

-

ManilaCarList

-

CarsInPhilippines

-

OLX Philippines

-

Auto Trade

-

South Asialink Finance Corp

-

Security Bank

-

EastWest Bank

-

Toyota Financial Services Philippines Corporation (TFSPH)

-

Maybank

-

RCBC

-

Metrobank

-

BPI

-

BDO Unibank

-

What has been the historical performance of the used car market in the Philippines, and what does the current situation look like?

-

How does the Philippines rank in the global automotive trade?

-

What challenges are encountered by participants in the Philippines' used car market?

-

In which city is the demand for used cars the highest?

-

What types of used cars are seeing a rise in demand within the Philippines?

-

Which city is anticipated to show significant growth potential in the coming years in the Philippines?

-

What type of fuel predominates in the Philippines' used car market?

-

What are the growth projections for the electric vehicle (EV) sector in the Philippines?

-

Who are the major players in the Philippines' used car market, and what does the investment landscape look like?

-

What opportunities are projected to propel revenue growth in the Philippines' used car market moving forward?

1.1. Research Objective

1.2. Research Design and Procedure

1.3. Data Collection Methods

1.4. Research Methodology

1.5. Analytical Framework

2.1. EPTD Analysis: Philippines Economic Overview

2.2. EPTD Analysis: Philippines Political Overview

2.3. EPTD Analysis: Philippines Technological Overview

2.4. EPTD Analysis: Philippines Demographic Overview

3.1. Philippines Trade Performance: An Overview

3.2. Philippines Trade Performance: Import

3.3. Philippines Trade Performance: Export

4.1. Philippines Used Car Market: An Overview

4.2. Philippines Taxes and Sales Trends

4.3. Philippines Sales Volume of Passenger Cars for Top 7 Brands by Segment and Model

4.4. Depreciated Cost of Vehicles: A Comparative Analysis

4.5. Philippines Used Car Market Revenue: Past and Present Performance

4.6. Philippines Car Ownership Trends

4.6.1. Philippines Car Ownership by Households

5.1. Philippines Used Car Market Segmentation

5.2. Philippines Used Car Market Segmentation: by Structure (Organized/Unorganized)

5.3. Philippines Used Car Market Segmentation: by Channel (Online/Offline)

5.4. Philippines Used Car Market Segmentation: by Car Brand

5.5. Philippines Used Car Market Segmentation: by Car Model and Body Type

5.5.1. Philippines Used Car Inquiries: by Brands and Models

5.6. Philippines Used Car Market Segmentation: by Fuel Type

5.7. Philippines Used Car Market Segmentation: by Region (Cities)

5.7.1. Philippines Used Car Dealers: by Tier I Cities

6.1. Philippines Used Car Market Competitive Landscape

6.2. Top Countries Visiting Autodeal and Carousell

7.1. Notification Requirements for Mergers and Acquisitions under the Philippine Competition Act

7.2. Market Mergers /Acquisitions/ Investments, 2018 – 2023

7.3. Funding Timeline

8.1. Company Profile: Carmudi Philippines

8.2. Company Profile: Zigwheels Philippines

8.3. Company Profile: Toyota Motor Philippines Corporation (T sure)

8.4. Company Profile: AutoDeal.com.ph

8.5. Company Profile: AutomartPh

9.1. Philippines Online Car Portals

10.1. Philippines Used Car Financing Companies

11.1. Philippines Used Car Market Opportunities

11.2. Philippines Used Car Market Future Outlook