Report Store Details

- Home

- Report Store Details

Philippines Logistics and Warehousing Market and Forecast (2018-2028) – Focus on Freight Forwarding, Warehousing, Cold Chain, Express Logistics and 3PL

- 19 Jul 2023

- Report Code: MK20555

- No of Pages: 226

Price From: $950

- Description

- Table Of Content

- Request Free Sample

Executive Summary

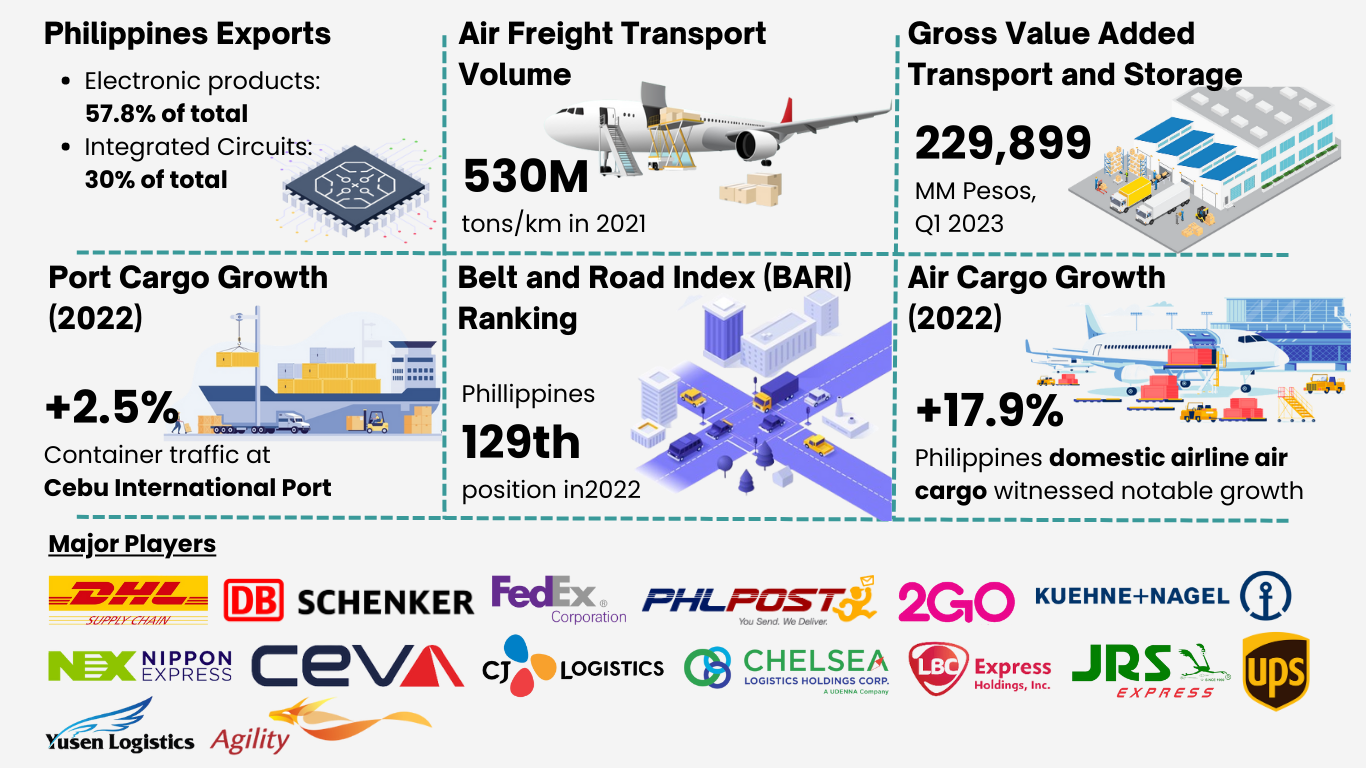

The logistics market in the Philippines is experiencing significant growth and presents numerous opportunities. With a population of over 100 million people, rapid urbanization, and a strategic location in Southeast Asia, the country is an attractive market for logistics services. The government has been investing in infrastructure projects to improve transportation networks, including roads, ports, and airports. These developments aim to enhance logistics efficiency and facilitate the movement of goods.

Road freight dominates the Philippines logistics market, while sea freight is gaining immense traction, with air freight contributing a minor share.

With the rise of online shopping and the need for efficient distribution networks, companies are investing in modern warehousing facilities to accommodate inventory storage, order fulfilment, and last-mile delivery. The demand for specialized warehouses, such as those catering to pharmaceuticals, food and beverages, and perishable goods, has also increased.

Increased domestic demand, international trade activities, and the quickly growing manufacturing sector of the Philippines has rose warehouse market revenue, registering a CAGR growth of 11% from 2018-22.

Increasing Demand for Road and Sea Transportation: The warehousing sector is expected to grow as a result of the growth of already existing technologies and technical equipment. As the nation's logistics industry transitions to digital growth, platooning and the deployment of electric vehicles are also assisting in reducing the cost of freight transportation and combating cargo theft. Over the next ten years, the need for logistics services will rise even more in the Philippines due to the country's expanding middle class, increased consumer expenditure, and young, tech-savvy population. Due to projects like the RESPOND and PCCP Project, employment opportunities will also increase in logistics in the years to come.

Increased Spending on Infrastructure to Propel the Logistics and Freight Forwarding Market: The Philippines has announced new projects in 2022 in the traditional sectors of transportation, energy, and water projects.

North Harbor's modernization and redevelopment have the potential to become an important catalyst in the country's domestic commerce.

Philippines Logistics and Warehousing Market By product segmentation

By Type of Warehouse: The warehouse market in Philippines by type consists of General purpose warehouse, cold storage, bonded warehouses and others. General purpose storage accounts for the major market share. The growing export-import trade, retail sector, and industrial production are boosting the demand for general warehouses.

By sector: The warehouse market in the Philippines by sector is divided into ecommerce, manufacturing, Industrial & Retail, Agriculture and others. As Filipino customers continue to swarm online marketplaces, e-commerce saw an unexpected rise. There is a growing demand for warehousing in the Philippines as more companies look for warehousing operations or services there. The manufacturing industry is expanding in the Philippines. The Philippines' expanding warehouse industry is primarily driven by increased domestic demand and global trade operations.

By Cities: There are 151 cold storage facilities accredited by the Department of Agriculture, with the majority located in Metro Manila (National Capital Region) (45), Central Luzon (30), and Calabaza (24). The remaining facilities are primarily located outside of Luzon in the Central Isaias (13) and Davao (18) areas

The logistics market in the Philippines holds tremendous potential, driven by factors such as infrastructure development, e-commerce growth, a rising middle class, and the expansion of the BPO industry. However, challenges related to infrastructure, congestion, and industry fragmentation need to be addressed for the market to reach its full potential.

Scope of the Study

The study conducted by Maker Research on the “Philippines Logistics and Warehousing Market and Forecast (2018-2028) – Focus on Freight Forwarding, Warehousing, Cold Chain, Express Logistics & 3PL " provides a comprehensive analysis of the market, encompassing a wide range of factors. The report takes into account both qualitative and quantitative factors, indicating a well-rounded approach to analysis. The inclusion of both qualitative and quantitative factors in the study ensures that readers gain a more complete understanding of the Philippines Logistics & Freight Forwarding Market. It goes beyond mere numbers and incorporates insights into consumer behavior, industry trends, and market dynamics. This holistic approach enhances the overall analysis and makes the study a valuable resource for individuals or organizations interested in exploring the logistics, warehousing, 3PL, cold chain, express logistics market in Philippines. Moreover, the report's focus on past and present performance, as well as potential growth opportunities in the future, enables readers to identify key areas of interest and investment.

Market Assessment: The report examines opportunity for the Philippines Logistics and Freight Forwarding market on various grounds including

- Logistics and Freight forwarding Market revenue and forecast

- 3PL Market revenue and forecast

- Warehousing Market revenue and forecast

- Cold Chain Market revenue and forecast

- Express Logistics Market revenue and forecast

- ecommerce logistics performance

Market Segmentation:

Market by Service Type

- Logistics

- Warehousing

- Value Added

Market Mode of Transportation

- Road Freight

- Sea Freight

- Air Freight

Market by Type of Warehouse

- General Purpose Warehouse

- Cold Storage

- Bonded Warehouse

- Others

Warehousing by Sectors

- E-commerce

- Manufacturing

- Industrial and Retail

- Agriculture

- Others

Cold Storage Demand by Cities

- Metro Manila

- Central Luzon

- Calabarzon & Others

Companies Covered:

- DHL Group

- FedEx Corporation

- United Parcel Services

- Yusen Logistics

- DB Schenker

- Nippon Express

- Kuehne+Nagel

- Agility Logistics

- CEVA Logistics

- Others (PHL Post, 2GO Logistics, Chelsea, Airspeed)

- Others (Airspeed, JRS Express, CJ Logistics)

Key Questions Addressed:

- How has the performance of the Philippine economy been in the past, and what is the expected growth outlook for the future?

- What has been the past performance of the logistics industry in the Philippines, and what is the current scenario?

- How has the warehousing industry responded to the challenges posed by COVID-19?

- What is the current growth rate of third-party logistics (3PL) in the Philippines, and what can be expected in the future?

- How is the demand shaping up for logistics service providers in the Philippines?

- What is the performance of the major sectors in the Philippines?

- Which mode of transportation dominates the logistics industry in the Philippines?

- Which sectors account for the major contribution to logistics demand in the country?

- Who are the key players in the market, and what is their current performance status?

- What are the key business highlights of these players?

- What is the present financial situation of the players, and what is their market share?

- How is the investment scenario in the Philippines?

1.1. Objective of the Study

1.2. Research Process

1.3. Data Collection Methods

1.4. Analytical Framework

1.4.1. Analytical Framework

2.1. Philippines : EPTD Analysis

2.1.1. EPTD Analysis: Philippines Economic Overview

2.1.2. EPTD Analysis: Philippines Political Overview

2.1.2.1. Political Overview: Logistics Performance Index of Philippines vs. Major Trading Partners

2.1.3. EPTD Analysis: Philippines Technological Overview

2.1.4. EPTD Analysis: Philippines Demographic Overview

3.1. Trade Performance of Philippines

3.2. Export Performance of Philippines

3.2.1. Export Performance of Philippines: 2021

3.3. Import Performance of Philippines

3.3.1. Import Performance of Philippines: 2021

3.4. Trade Performance of Philippines: by Sectors

3.4.1. Philippines Trade Performance: Food and Beverages

3.4.2. Philippines Trade Performance: Textile

3.4.3. Philippines Trade Performance: Electronic

3.4.4. Philippines Trade Performance: Machines

3.4.5. Philippines Trade Performance: Chemicals

4.1. Logistics Infrastructure in Philippines: Road Transport

4.2. Logistics Infrastructure in Philippines: Rail Transport

4.2.1. Logistics Infrastructure in Philippines: Rail Transport

4.3. Logistics Infrastructure in Philippines: Air Transport

4.3.1. Logistics Infrastructure in Philippines: Air Transport

4.4. Logistics Infrastructure in Philippines: Maritime Transport

4.4.1. Philippines Container Port Traffic

4.4.2. Philippines: Liner shipping connectivity index

5.1. Philippines Manufacturing Industry Performance: 2022

5.1.1. Philippines Manufacturing Industry Performance: 2023

5.1.2. Philippines Manufacturing Industry: Gross Value Added

5.2. Philippines Chemicals Industry Performance

5.2.1. Philippines Chemicals Industry: Gross Value Added

5.3. Philippines Electrical and Electronic Industry Performance

5.3.1. Philippines Electrical and Electronic Industry Quarterly Performance

5.3.2. Philippines Electrical and Electronic Industry Performance: Smartphone

5.3.3. Philippines Electrical and Electronic Industry Performance: Personal Computers

5.3.4. Philippines- Electronics Sector Analysis: Wearable’s

5.3.5. Philippines Electrical and Electronic Industry Performance: Consumer Electronics

5.3.6. Philippines Electrical and Electronic Industry Performance: Semiconductor

5.3.6.1. Philippines Export Value of Semi-Conductor

5.4. Philippines Mineral Products Industry Performance

5.4.1. Philippines Mineral Products Industry Performance: Copper

5.4.1.1. Philippines Mineral Products Industry Performance: Copper–Cathodes

5.4.2. Philippines Mineral Products Industry Performance: Gold

6.1. Philippines Logistics and Warehousing Market: An Overview

6.1.1. Philippines Logistics and Warehousing Market: Key Facts

6.1.2. Philippines Logistics Market: Gross Value Added (2018-2020)

6.1.3. Philippines Logistics and Warehousing Market: Infrastructure Expenditure

6.2. Philippines Logistics and Warehousing Market: Past and Present Performance

6.2.1. Impact of COVID-19

6.2.2. Philippines Logistics Market: Belt and Road Index

7.1. Philippines Logistics Market: Past & Present Performance

7.2. Philippines Logistics Market: By Freight Movement (Road, Air, Marine)

7.2.1. Philippines Freight Movement: Sea Freight

7.2.1.1. Philippines Sea Freight Cargo Throughput

7.2.1.2. Philippines Sea Freight Cargo Throughput: Domestic vs. International Q1 2023

7.2.1.3. Philippines Sea Freight Container Traffic

7.2.1.4. Philippines Sea Freight Container Traffic: by Ports

7.3. Philippines Freight Movement: Domestic Air Cargo

7.3.1. Philippines Domestic Air Cargo : H1 2022

7.3.2. Philippines Domestic Air Cargo : H1 2022

7.3.3. Philippines Domestic Air Cargo Traffic Flow: 2022 & Q1 2023

7.4. Philippines Freight Movement: International Air Cargo

7.4.1. Philippines International Air Freight Cargo Traffic Flow : 2022 & Q1 2023

7.5. Philippines Freight Forwarding Market by Freight Movement : Land Freight

8.1. Philippines Third-Party Logistics (3PL) Market : An Overview

8.2. Philippines Third-Party Logistics Market : Past & Present Performance

9.1. Philippines Warehousing Market : An Overview

9.2. Philippines Warehouse Demand Supply Gap

9.3. Current Lease Rates of Warehouses by Cities as of Mar 2023

9.4. Philippines Warehousing Market: Past & Present Performance

9.5. Philippines Warehousing Market Segmentation : by Type of Warehouses

9.6. Philippines Warehousing Market Segmentation : by Sector

10.1. Philippines Cold Chain Market: An Overview

10.2. Philippines Cold Chain Market: Demand

10.3. Philippines Lease Rates of Refrigerated Warehouses

10.4. Philippines Load Limit Per Pallet

10.5. Philippines Inbound and Outbound Cargo Expenditure

10.6. Philippines Cold Chain Market Challenges

10.7. Philippines Cold Chain Market: Past & Present Performance

10.7.1. Philippines Cold Chain Market: By Cities

10.7.2. Number of Cold Storage and Warehouse Facilities in the Philippines

11.1. Philippines Express Delivery Market: An Overview

11.2. Reasons to Adopt Express Logistics Market in Philippines

11.3. Philippines Express Logistics Market Past and Present Performance

12.1. Digital Outlook of Philippines

12.2. E-commerce Market Potential and Growth

12.3. Philippines e-commerce Market Value

12.4. E-commerce Logistics System in the Philippines

12.5. Increasing Digital Payments in the Philippines Market

12.6. Impact of E-commerce Growth in the Philippines Logistics Market

13.1. Philippines Logistics and Warehousing Market: Future Outlook

13.2. Philippines Third-Party (3PL) Logistics Market Forecast

13.3. Philippines Warehousing Market Forecast

13.3.1. Philippines Cold Chain Market Forecast

13.4. Philippines Express Logistics Market Forecast

13.5. Factors to Drive the Philippines Logistics and Warehousing Market

14.1. Market Dynamics: Recent Trends & Development

14.2. Market Dynamics : Market Drivers

14.3. Market Dynamics: Challenges

15.1. Philippines Logistics Market Competitive Landscape: Market Share of Key Players

15.2. Air Freight: Domestic Forwarders Market Share

15.3. Air Freight: International Forwarders Market Share

16.1. Mergers /Acquisitions/ Investments: DHL Group

16.2. Mergers /Acquisitions/ Investments: FedEx Corporation

16.3. Mergers /Acquisitions/ Investments: United Parcel Services

16.4. Mergers /Acquisitions/ Investments: Yusen Logistics

16.5. Mergers /Acquisitions/ Investments: DB Schenker

16.6. Mergers /Acquisitions/ Investments: Nippon Express

16.7. Mergers /Acquisitions/ Investments: Kuehne+Nagel

16.8. Mergers /Acquisitions/ Investments: Agility Logistics

16.9. Mergers /Acquisitions/ Investments: CEVA Logistics

16.10. Mergers /Acquisitions/ Investments: Others (PHL Post, 2GO Logistics, Chelsea, Airspeed)

16.11. Mergers /Acquisitions/ Investments: Others (Airspeed, JRS Express, CJ Logistics)

17.1. Company Profile: DHL Group

17.2. Company Profile: FedEx Corporation

17.3. Company Profile: United Parcel Services

17.4. Company Profile: Yusen Logistics Co. Ltd.

17.5. Company Profile : DB Schenker

17.6. Company Profile: Nippon Express

17.7. Company Profile : Kuehne+ Nagel AG

17.8. Company Profile: Agility Logistics

17.9. Company Profile: CEVA Logistics

17.10. Company Profile: PHL Post

17.11. Company Profile: 2GO Logistics Inc.

17.12. Company Profile: Chelsea Logistics

17.13. Company Profile: LBC Express Holdings, Inc.

17.14. Company Profile: Airspeed

17.15. Company Profile: JRS Express

17.16. Company Profile: CJ Logistics

18. Analyst Recommendations

Limitations of the Study|

List of Figures & Tables

Philippines GDP Growth (Annual %), 2018-2023

Philippines Consumer Inflation Rate (%), 2018-2023

FDI Net inflows in Philippines, 2018-2022

Gross National Income per capita in Philippines, 2018-2021

Philippines Comparative Analysis of Economic Performance V/s Other ASEAN Countries, 2021-2022

Comparative Analysis of Logistics Index of Philippines V/s Major trading partners, 2023

Population of Philippines, 2018-2021

Urban Population of Philippines (Percentage of total Population), 2018-2021

Philippines Unemployment Rate, 2019-2022

Philippines Unemployment Rate, 2019-2022

Philippines Merchandise Exports, 2018-2022

Top Exports from Philippines, 2021 (%)

Top Exporting countries from Philippines, 2021 (%)

Philippines Merchandise Imports, 2018-2022

Top Imports for Philippines in 2021 (%)

Top Importing Countries for Philippines, 2021 (%)

Top Importing Countries for Philippines, 2021 (%)

Philippines Textile Trade Performance, 2019 to 2021

Philippines Electric Industry Trade Performance, 2019-2022

Philippines Machine Trade Performance, 2019 to 2021

Philippines Chemical Trade Performance, 2019 to 2021

Philippines Total Route of Rail Lines, 1995-2016

Philippines Air Freight Transport, 2015-2021

Philippines Container Port Traffic (TEU: 20 foot équivalent units), 2012-2021

Philippines Liner Shipping Connectivity Index (maximum value in 2004 = 100)

Gross Value Added by Manufacturing Industry, 2018-2022

Gross Value Added by Chemical and Chemical Products, 2018-2022

Philippines Value of Electronics Products exported, Quarterly, 2020 to 2022

Units of Smart Phones Sold in Philippines, 2019-2022

Philippines, Units of Personal Computers Sold, 2019-2022

Philippines, Shipment of Wearable, Q3 2021- Q3 2022

Philippines, Export Value of Consumer Electronics, Quarterly, 2020 to 2022

Philippines, Export Value of Semi-Conductors, Quarterly, 2020 to 2022

Philippines Gross Value Added in Mining Industry, Quarterly, 2020-2022

Cathodes of Refined exported from Philippines, Quarterly, and 2020-2022

Gross Value of Gold and other precious metals in Mining Industry, Quarterly, and 2020-2022

Gross Value Added in Transport and Storage AT Current Price, 2018 – Q1 2023

Gross Value Added in Transportation and Storage Quarterly Performance, 2018-2020

Gross Value Added in Transportation and Storage Quarterly Performance, (2021-Q3 2023)

Gross Value Added in Transportation and Storage, by Philippine Region at constant price, 2020-2022

Philippines Logistics and Warehousing Market Revenue, 2018-2022

Philippines Logistics and Warehousing Market by Segmentation, 2022

Philippines Ranking of the belt and road index (BARI) among Asian Countries, 2022

Philippines Logistics Market Revenue, 2018-2022

Philippines Logistics Market by Freight Movement, 2022

Philippines Cargo Throughput, 2018 - Q1 2023

Philippines Domestic Cargo Throughput of Major Ports, Q1 2023

Philippines International Cargo Throughput of Major Ports, Q1 2023

Philippines Container Traffic, 2018 - Q1 2023

Philippines Domestic Air Cargo Traffic Flow by Cargo Weight (Volume), 2018- Q1 2023

Philippines Top 10 Domestic Forwarders Cargo Traffic Flow CY 2023 (Jan-Mar)

Philippines Top 10 Domestic Forwarders Cargo Traffic Flow CY 2022

Philippines International Air Cargo Traffic Flow by Cargo Weight (Volume), 2018- Q1 2023

Philippines Top 10 International Forwarders Cargo Traffic Flow CY 2023 (Jan-Mar)

Philippines Top 10 International Forwarders Cargo Traffic Flow CY 2022

Philippines Third Party Logistics Market Revenue, 2018-2022

Philippines Warehousing Market Revenue, 2018-2022

Philippines Types of Warehouse in Terms of Revenue (%), 2022

Philippines Warehouse Market by Sectors in terms of Revenue (%), 2022

Current Lease Rates of Cold Storage Facilities in the Philippines

Load per Pallet for Commodities that Require Cold Storage Facilities for Preservation

Cost Build-up for Inbound and Outbound Cold Storage in Philippines

Philippine’s Cold Chain Market Revenue, 2021 & 2022

Market Share of Cold Chain Storage by Cities

Philippine Cold Chain Total Capacity, 2021-2023

Philippine Agriculture Cold Storage Facilities by Cities as of Sep 2021

Philippine Agriculture Cold Storage Facilities by Cities as of Sep 2021

Philippines Express Logistics Market Revenue, 2018-2022

Philippines ecommerce Market Value in the Philippines, 2015-2025

Philippines Logistics and Warehousing Market Revenue Forecast, 2023F-2028F

Philippines Logistics Market Revenue Forecast, 2023F-2028F

Philippines Third Party Logistics Market Forecast, 2023F-2028F

Philippines Warehouse Market Forecast, 2023F-2028F

Philippines Cold Chain Market Revenue Forecast, 2023F-2028F

Philippines Express Logistics Market Revenue Forecast, 2023F-2028F

Philippines Logistics Market Major Players Market Share (%)

Philippines Leading Domestic Air Freight Forwarders Market Share by Cargo Traffic Flow (%), CY 2023 (Jan-Mar)

Philippines Leading Domestic Air Freight Forwarders Market Share by Cargo Traffic Flow (%), 2022

Philippines Leading International Air Freight Forwarders Market Share by Cargo Traffic Flow (%), CY 2023 (Jan-Mar)

Philippines Leading International Air Freight Forwarders Market Share by Cargo Traffic Flow (%), 2022

DHL Group, Quarter 1 Financial Performance (Global), Q1- 2023 and Q1- 2022

DHL Group, Global Consolidated Total Revenue, 2018 to 2022

DHL Group Revenue by various Divisions, 2022 (%)

DHL Group, Total Domestic Revenue by Segments, 2018 to 2022

FedEx Corporation, Global Total Domestic Revenue by Segments, 2018 to 2022

United Parcel Services, Financial Performance (Global), Q1 2023 and Q1 2022

United Parcel Services, Global Consolidated Total Revenue, 2018-2022

United Parcel Services, Global Total Domestic Revenue by US Domestic Package Segments, 2018-2022

United Parcel Services, Global Total Domestic Revenue by International Package Segments, 2018-2022

DB Schenker, Asia Pacific Consolidated Total Revenue, 2018-2022

Nippon Express, South East Asia and Oceania Consolidated Total Revenue, 2018-2022

Kuehne+Nagel, Asia Pacific Total Turnover, 2018-2022

Agility Logistics, Asia Total Revenue, 2018-2021

PHL Post Total Revenue, 2018 - 2021

PHL Post Breakdown of Revenue, 2018 - 2021

2GO Group Inc., Total Revenue, 2018 - 2022

Chelsea Logistics, Total Revenue, 2018 - 2022

Chelsea Logistics, Total Revenue by Segments, 2020- 2022

LBC Express, Domestic Revenue by Segments, 2018 - 2022

LBC Express Holdings, Inc., Domestic Revenue, 2018 - 2022

LBC Express Holdings, Inc. Financial Performance, Q1 2022 vs. Q1 2023