Report Store Details

- Home

- Report Store Details

India Used Car Market Size and Forecast (2018-2030) – Segmentation by Dealer Type, Sales Mode, Car Type, and Demand by Cities

- 19 Mar 2024

- Report Code: MK20606

- No of Pages: 113

Price From: $1000

- Description

- Table Of Content

- Request Free Sample

India Used Car Market Revenue

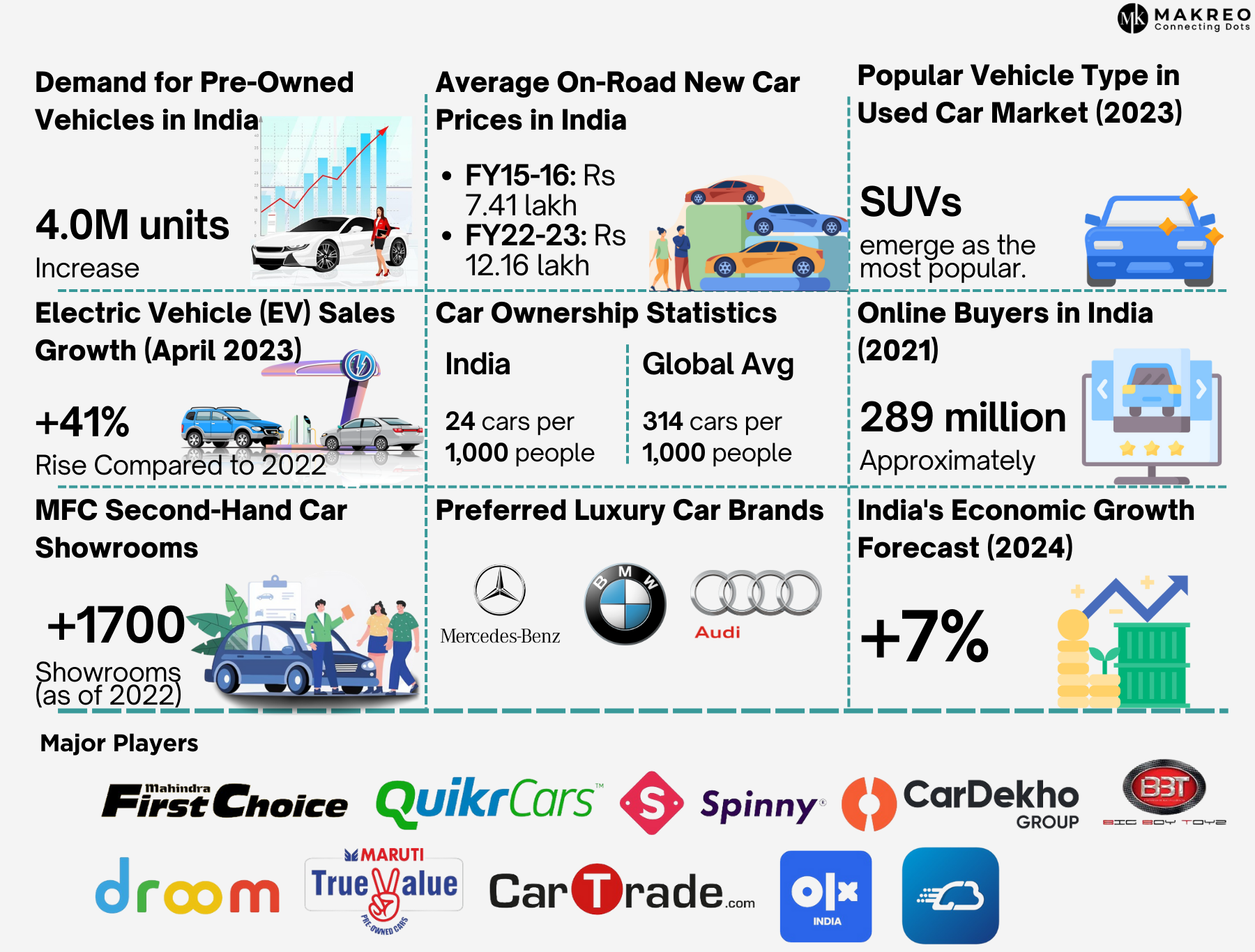

The India used car market has experienced steady revenue growth, achieving a compound annual growth rate (CAGR) of 9.7% from 2018 to 2023, reaching a total of USD 35.46 billion. The sales volume of pre-owned vehicles saw a notable increase, with approximately 4.6 million units sold in the first nine months of 2023, compared to 4.2 million units in 2022. Major regions such as Delhi-NCR, Bengaluru, and Hyderabad have emerged as key hubs for used car demand in 2023, highlighting the continued expansion of the second-hand car market in India. This growth reflects a broader trend across the India pre-owned car market, including key cities like Mumbai, Chennai, and Pune, driven by both traditional used car dealers and the rise of online used car sales platforms.

India Used Car Market Trends

-

The rise of digitization has played a crucial role in addressing persistent challenges in the India used car market. This digital transformation has enhanced business operations, increased transaction transparency, and boosted consumer trust. With the continuous rise in new car prices, the value of second-hand vehicles in India has also climbed. However, car ownership remains comparatively low in India, with only about 8% of the population owning a four-wheeler, in contrast to developed markets such as the US, China, and Europe, where ownership rates are significantly higher.

-

A key indicator of the growing demand for used cars in India is the shortening of the car ownership cycle. The younger demographic is increasingly selling their vehicles within 5-6 years of purchase, compared to the previous trend where cars were kept for 10-12 years. This shift in vehicle lifecycle patterns highlights the changing attitude toward car ownership in India.

-

Strategic mergers, acquisitions, and investments by major players are reshaping the used car market landscape in India, aimed at strengthening capabilities and offering more comprehensive solutions. The demand for pre-owned vehicles is higher in non-metro areas, although supply remains concentrated in urban centers. Small towns are anticipated to be the main drivers of growth in the used car sector, with companies that cater to these regions expected to gain a competitive edge. The market is evolving rapidly, with substantial growth projected due to the growing acceptance of pre-owned cars in India. Businesses embracing sustainability, affordability, and strategic partnerships are poised for success, particularly in regions like Delhi NCR, Mumbai, Bengaluru, Hyderabad, Chennai, and Pune, where used car dealerships are becoming increasingly prominent.

India Number of Used Cars Sold, 2018-2023

Competitive Landscape of the India Pre-Owned Car Market

The report provides an in-depth analysis of key players in the India used car market, covering a wide range of companies, from well-established dealerships to innovative online platforms. Prominent names in the market include Cars24, Maruti Suzuki True Value, Mahindra First Choice Wheels Limited, OLX India, CarTradeTech, Big Boy Toyz, Droom, Car Dekho, Spinny, and Cholamandalam. These companies represent various segments, from the traditional used car dealerships like Maruti Suzuki True Value and Mahindra First Choice Wheels Limited to digital-first platforms such as OLX India and Droom, reflecting the ongoing digital transformation in the India pre-owned car industry. This report offers a comprehensive view of the competitive dynamics shaping the growth of the India used car market.

Online Surge in India Used Car Market

India's demographic is recognized as one of the most diverse and youthful globally. Recent trends in the India used car industry show a marked shift in consumer preferences, largely driven by the growing prominence of e-commerce and wider internet access. As a result, there has been a substantial rise in the demand for online used car sales in India, reflecting the evolving dynamics of the pre-owned vehicle market in India. This surge highlights a key transformation in how consumers are engaging with the used car market in India, particularly in urban areas, where digital platforms are gaining significant traction.

Future Growth Outlook

The growth of India's used car market is poised to accelerate due to the country's robust economic growth and increasing middle-income population. A significant shift in consumer perception has occurred, with used cars no longer being seen purely as status symbols. Compared to developed nations, India has substantial untapped potential in the used car market, driven partly by the growing preference for certified pre-owned vehicles, which are refurbished to nearly new condition. With a population exceeding 1.4 billion, India offers a vast customer base for the used car market to tap into in the coming years. The report not only evaluates the historical and current performance of the India used car market but also identifies crucial factors that will influence its future growth. This analysis is designed to offer stakeholders valuable insights into potential opportunities and challenges within the market.

India Used Car Sale Volume Forecast

Scope of India Used Car Market Research Report

Makreo Research recently released a comprehensive report titled "India Used Car Market Size and Forecast (2018-2030) – Segmentation by Dealer Type, Sales Mode, Car Type, and Demand by Cities." The report offers a detailed analysis of key players in the Indian used car industry, including Cars24, Maruti Suzuki True Value, Mahindra First Choice Wheels Limited, OLX India, CarTradeTech, Car Dekho and Cholamandalam. It begins with a competitive analysis of these companies, focusing on their market shares, and then delves into detailed discussions about them, including insights into mergers, acquisitions, funding, and comprehensive company profiles with a specific focus on financial aspects. The report also examines the historical and current performance of the market and provides a comprehensive analysis of its future in India. This information equips stakeholders and industry experts with a deep understanding of the evolving dynamics of this rapidly growing and evolving market in India.

- 2018 - 2022: Past and Present Scenario

- 2023: Base Year

- 2024 - 2030: Future Outlook of the Market

- Market Size and Forecast

- Used Car Market Volume Sales

- Used Car Demand by Type of Cars

- Used Car Demand by City

- Used Car Demand by Fuel Type

- Used Car Demand by Dealer Type

- Cars 24

- Maruti Suzuki True Value

- Mahindra First Choice Wheels Limited

- OLX India

- CarTradeTech

- Big Boy Toyz

- Droom

- Car Dekho

- Spinny

- Cholamandalam

-

How is the current used car market in India performing?

-

Who are the key players dominating the India Used Car Market?

-

How does the market capitalization of major players in the Indian used car sector relate to their revenue?

-

What factors influence investment decisions among the primary players in the India pre-owned vehicle market?

-

What significant milestones have key players in the Indian used car market achieved in their business?

-

Which major mergers and acquisitions have had a significant impact on the history of the Indian pre-owned car market?

-

How is the current funding landscape distributed among various participants in the sector?

-

What emerging trends and innovations are driving growth in the Indian used car sector?

-

How do regulatory changes affect the operational strategies and growth plans of key players in the Indian pre-owned vehicle market?

-

What technological advancements are reshaping the India used car market?

-

What challenges are key players in the Indian used car sector facing, and how are they addressing them?

-

What role do marketing and branding play in the success of major players in the Indian used car market?

-

What are the growth prospects and future outlook for the Indian used car market?

1.1. Objective of the Study

1.2. Research Process

1.3. Data Collection Methods

1.4. Analytical Framework

2.1. India Used Car Demand

2.1.1. India Used Cars vs. Passenger Vehicle's Demand

2.2. India Used Car Demand

2.3. India Used Car Market Revenue – Past & Present Performance

2.3.1. India Leading Used Car Dealers

2.3.2. India Leading Used Car Models

3.1. India Used Car Market Segmentation

3.2. India Used Car Market Segmentation - Dealer Type

3.3. India Used Car Market Segmentation - Digital and Traditional Channels

3.4. India Used Car Market Segmentation - Car Type

3.5. India Used Car Market by Region – Metro and Non-Metro Cities

4.1. India Used Car Market Competitive Analysis

4.1.1. Market Mergers /Acquisitions/Investments/Divestments

4.1.2. Funding Timeline

5.1. Company Profile: Cars 24

5.2. Company Profile: Maruti Suzuki True Value

5.3. Company Profile: Mahindra First Choice Wheels Limited

5.4. Company Profile: OLX India

5.5. Company Profile: CarTradeTech

5.6. Company Profile: Big Boy Toyz

5.7. Company Profile: Droom

5.8. Company Profile: CarDekho Group

5.9. Company Profile: Spinny

5.10. Company Profile: Cholamandalam (Chola)

6.1. India Used Car Market Threats

6.2. India Used Car Market Opportunities

7.1. India Used Cars Sales Volume Forecast, 2025F – 2028F

7.2. India vs USA/UK Comparison of Car Ownership Rates, 2023

7.3. India Used Car Market Best and Worst-Case Scenario, FY’2024E – FY’2030F

7.4. India Per Capita GDP vs. Other Developing Nations, 2022

7.5. India Used Car Market Moderate Case Scenario, FY’2024 – FY’2030

Limitations of the Study